I've had some private Facebook messages requesting me to share some tips & tricks on elminating debt. This means I have more readers than followers! While I started this blog because I'm looking to figure out my finances now that my debt is wiped clean, there are some must-reads that I would recommend for every girl looking to have more funds.

I've had some private Facebook messages requesting me to share some tips & tricks on elminating debt. This means I have more readers than followers! While I started this blog because I'm looking to figure out my finances now that my debt is wiped clean, there are some must-reads that I would recommend for every girl looking to have more funds.

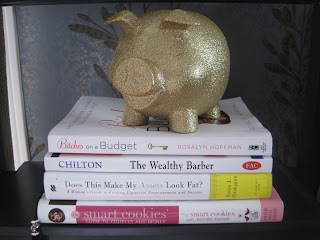

The Smart Cookies' Guide To Making More Dough: How Five Young Women Got Smart, Formed A Money Club, And Took Control Of Their Finances

Andrea Baxter

This came recommended by my BFF /fellow Sporty Spice. It gave me the motivation to o

pen my Visa and take control of my finances because I finally realized that I could have any life I wanted if I took the time to manage my money and think about my long-term goals. It is written from the perspectives of 5 ladies who all have interesting careers (PR, marketing, social work) and are at different stages in their relationships (single, divorced, engaged), but were charging up their debt in an effort to maintain an appearance or handing over their financial control to the men in their lives. Who can't relate to that? By sharing their financial situations with one another, the women found motivation to pay off debt and establish money-managing plans for their goals. The book includes budgeting techniques, tips on being a smart spender, and advice on how to make more "dough".

pen my Visa and take control of my finances because I finally realized that I could have any life I wanted if I took the time to manage my money and think about my long-term goals. It is written from the perspectives of 5 ladies who all have interesting careers (PR, marketing, social work) and are at different stages in their relationships (single, divorced, engaged), but were charging up their debt in an effort to maintain an appearance or handing over their financial control to the men in their lives. Who can't relate to that? By sharing their financial situations with one another, the women found motivation to pay off debt and establish money-managing plans for their goals. The book includes budgeting techniques, tips on being a smart spender, and advice on how to make more "dough".

The advice on budgeting seems strict at first as it encourages compartmentalizing all upcoming expenses and paying in cash using "money envelopes". None the less, last July I had nothing to lose so I opened up my Excel, planned my first 4-wk rolling budget and started my envelopes: e.g. household purchases ($100/month); groceries ($120/week); and fun money ($80/week). Obviously the fun money was my favourite envelope! After taking the time to budget all my upcoming expenses and debt payments, I determined that I could afford $80/week for fun. I use the cash for anything I want - coffee at work, dinner out, a botte of wine, a fun nailpolish, or a little dress from Winners. The trick to the "fun money" is to establish an amount that you can afford and not to feel guilty about spending money it. After all, you're taking the time to make sure everything else is paid off so this is a small personal indulgence that lets you feel empowered about your shopping and not feeling deprived by your budget.

The Smart Cookies Guide is relatable and is an excellent first-step to becoming financially fabulous. It is also Oprah-approved as one of her favourite things. The bonus? The women are Canadian so all the financial tools that they share are practical for us Canadian chicks! The hard-cover edition is a bargain book at Chapters right now for $6.99, so I'd classify this book as an amazing investment.

The Wealthy Barber Gold Edition

David Chilton

My Eye Candy gave me this book over two years ago, but it took some time for me to actually pick it up. After all, financial planning is not the most exciting topic, but I wish I hadn't waited so long. I think this should be mandatory reading for every student and the younger the better. It is now my favourite gradution gift for friends & family.

While it is slightly hokey-pokey at parts, David Chilton shares stories of his trip to see the Roy - the local wealthy barber who cuts your hair and if you're lucky, dispenses personal financial planning advice. The book is easy to read and the financial strategies are even easier to implement. It's common sense for financial planning and as I went through the chapters, I found myself taking action. I now take 10% off my gross income automatically off my paycheck and it directly goes into my RRSP. Since I started this 7 months ago, my RRSP value has doubled what it took me 3 years to save up! It is almost shameful to admit that! But the best part? I don't even notice the impact in my day-to-day life of putting away 10% into my RRSP, but I'm sure the fabulous 65 year old version of myself is already thanking me for maintaining her wonderful lifestyle.

Another tip that I put into action was the life-insurance. For $50 a month, I was putting away money into a huge life-insurance policy. Ummm... why? The truth is because when I started my job, I just kept signing forms and filling in options because I thought that was what every good first-time full-time worker does. But when I thought about it, at this point in my life, I don't need to spend money on life insurance. I am not married (yet... hint, hint), nor the sole bread-winner in my relationship, and I have no children. For now, I am better off taking the money and putting into another investment.

I plan to reread The Wealthy Barber in the next month as there were parts that initially went over my head about investing simply because I was so concerned about paying off my debt that the timing was not right to implement. And like Smart Cookies, this book is Canadian based. So if you've not read The Wealthy Barber yet, let me know when your birthday is coming up.

Bitches on a Budget

Rosalyn Hoffman

I ordered this book online after seeing it in-store and decided it would be a witty read. Hoffman did not disappoint! It is the chick lit of personal finance. While the Canadian economy did not have the same recession crisis as our USA neighbours, saving money is always in style. There are tips for being a smart shopper like when to splurge on the items based on the seasons and retailers to keep on your shopping circuit (sidenote: I am so excited that Target is coming to Canada soon as this seems to be the mecca of every recessionista) and I found the tips to be new and relevant... not just the same old "skip your coffee for $3 a day and you'll have a $1000 at the end of the year". (While I respect the latte-factor tip, I genuinely enjoy my $1.25 Tim Horton's tea as it's a chance to "network" with my colleagues and escape my cubicle life for at least 10 minutes a day.)

Bitches on a Budget also gives ideas on how to maintain your wonderful lifestyle no matter what your budget - how to decorate your nest, what to order when you go out for a night on the town that's healthy & thrify, how to pamper your pooch without giving her a wardrobe more impressive than your own, and encouragement to get fit while keeping your bank account in shape. All in all, it is a fun-yet-frivilous-but-financially-fabulous read. I encourage every girl to unleash her inner bitch on a budget!

I am currently reading Does This Make My Asets Look Fat? A Woman's Guide to Finding Financial Empowerment and Success by Susan Hirshman which is all about finding the right mix of investments in your portfolio. It's on my beside table right now so expect a review soon... and my adventure in buying some assets.

A great article written with great hard work...i must say....a great work of your which shows...I like your site its quite informative and i would like to come here again as i get some time from my studies. And I will share it with my friends.

ReplyDelete