I've revisted my 4wk rolling budget this evening as I have a few more big and exciting expenses coming up. In addition to the recently added car payments, my Eye Candy and I are headed to Las Vegas in May for a 5 day adventure with my cousins. And as a graduation gift, I'm treating my sister too. After 6 years of studying, she more than deserves some time off to play and there is no better place to do that than Sin City. I'm already shaking glitter off my clothes!

One of my financial goals is to never go on a vacation that I can't pay for - my last holiday got me into trouble in the first place, and I never want to do that again. I have $1425 saved up in my vacation account and with clever online shopping, this will be enough to pay for both my sis and me. I haven't officially booked yet as I'm waiting for my other cousin to get back from the beaches of Cuba to get his ok with all the plans - I just hope the deals that I found will last a few more days.

So all that being said, my new favourite word is "free". My Eye Candy asked me what I wanted to do today and I said exactly that. We spent the morning working out at the YMCA (I pay a monthly membership, so it was not free but at least I'm maximizing my $50 cost) and a fun afternoon walking around Old Port with our puppy. Our only expense was $5 for parking. And this evening, I've just done something that made the 13 year-old-girl-in-me squeal... I visited the Montreal library online site and reserved the chick lit books that were next on my list. While I love Chapters Indigo, they are no longer getting my money. I'll be able to pick up my books next weekend for the cost of nothing. Fabulously convenient and free! This will save me $25 a month.

Leading up to Las Vegas, these are the other fabulous ways that I am going to free-up my fun money for fun on the Strip. I'm still going to put $80 a week into my wallet, but I'm hoping to cut back on the frivilous and instead, use the remaining cash for my vacation.

1. Brown bag lunches - I'll be bringing my lunch everyday to work. While I usually do this 3-4 times a week anyways, I can still kick it up a notch and save at least $15 a week. Plus, my lunch is in a super cute black Elle insulated tote bag so no trees will be hurt in the process. 2. Improve my liquidity - About 2x a week, I stop at Liquid Nutrition after working-out in the mornings to grab a protein-fruit smoothie (Nuts About You is my favourite and it's the exact same calorie count as what I burn so I pretty much break-even). However, moving forward, I'm going to make my smoothie chez moi the night before, freeze it, and let it defrost while I exercise. This should save me $10 a week. *Disclaimer: My Eye Candy has just informed me that a defrosted smoothie will taste awful as the whey protein powder will break down. I'll try this tomorrow and if it is doesn't work, then I'll find a new breakfast solution. 3. Dinners out on the town - will be made from our Mad Money. Each week, my Eye Candy and I put grocery money into an envelope ($120 each) and anything that is what we call our Mad Money and we can spend it on whatever we like. Because I do enjoy eating out with friends, I want to keep doing so, but only if there is Mad Money sitting in the envelope.

4. BYOW - is my new favourite abbreviation. This stems from the point above, but I'm finding the best BYOW restaurants in Montreal and making my reservations there. La Prunelle is already my favourite and I can't wait to find more. *Disclaimer, should my Eye Candy insist on buying a bottle and offering me a glass, then I can't turn down that generous gesture. His money = his purchase. 5. The latte factor - this one will hurt as I already drink so few coffees at work unless it's to socialize or get an emergency caffeine buzz. But it still costs me about $10 a week. I do now resolve to make my beddazzled diamond thermos my new BFF and after my morning coffee chez moi, I'll only sip herbal teas throughout the day as I can pick up a package of sachets with my groceries and boiled water is, well, free.

6. Forty days of only window shopping - And this will be the hardest of all, which is why I am being realistic with the timeline. After all, I do live in Canada and the weather changes dramatically - I might genuinely need new clothes! But for the most part, I do need new clothes. So I will not to make a clothing, shoe, or accessory purchase until April 1st. Instead, I will spend the next 40 days planning the most fabulous outfits to wear in Las Vegas that come from Boutique Rosie. This will free up at least $300 for me to put in the vacation account. My clothes don't entirely come out of my fun money, but it will still let my bank account breathe.

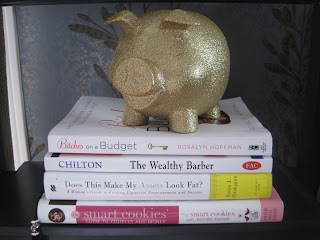

7. Subscriptions only - In addition to making the library my new best friend for books, I will avoid the stands of glossy magazines at the grocery check-out. After all, I have 6 subscriptions and receive an infinite amount through work. I don't need anymore... no matter how transformational I think the content will be.

I was hoping to add 3 more tips to this list just to make it a Ten Commandments for Fun Money, but I couldn't think of anymore. If there are other ideas, please share.

*Rosie*

At the start of 2010, I made a New Year's Resolution to become financially fabulous. I promised myself that I would start reading the business sections of the newspaper daily and I'd log-on to the Globe & Mail's investors pages more often than my Facebook account. It had been three years since I had graduated with a business degree and after kick-starting my career in marketing, I felt like I had little to show for it... Some cash saved up here & there and a super cute apartment, but overall, when it came to talking dollars and cents I felt like I had no sense.

At the start of 2010, I made a New Year's Resolution to become financially fabulous. I promised myself that I would start reading the business sections of the newspaper daily and I'd log-on to the Globe & Mail's investors pages more often than my Facebook account. It had been three years since I had graduated with a business degree and after kick-starting my career in marketing, I felt like I had little to show for it... Some cash saved up here & there and a super cute apartment, but overall, when it came to talking dollars and cents I felt like I had no sense.